Debt Aware

Money Matters - Debt Aware

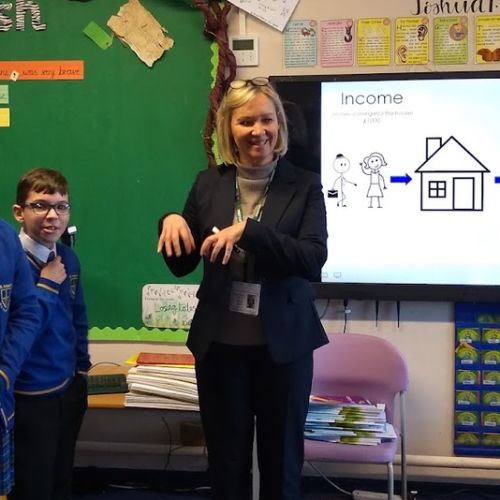

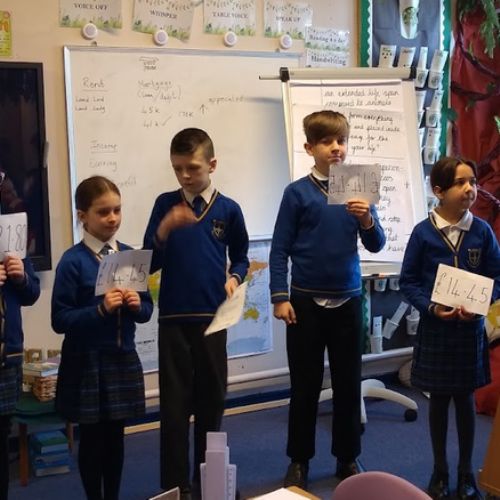

For several years now, our children receive financial education in the form of tailored lessons delivered by Debt Aware. Children in Year 5 and 6 are trained as 'money mentors' and deliver sessions on budgeting, 'wants' versus 'needs,' borrowing money, interest and savings. Financial education is an invaluable life skill for our children. The lessons are delivered in a fun and accessible way using materials provided by the Debt Aware Foundation

What are children have learnt:

There are loads of things that we want but what we actually need has to be a priority. Y5

If you are taking a loan out, you should ask yourself is this for a necessity or a luxury. Necessity should be number one. Y5

There is good debt and bad debt. Good debt is when you buy something like a car for work and you can make all the repayments. Y5

No matter your age, saving is important, for example if you get birthday money, always make sure you put some aside. Y5

National Living Wage is different dependent on your age. Y6

We pay a lot of tax in this country, Gross pay is high because it's before you have been taxed. Net pay is what you earn after you have been taxed. Y6